introduction

Renters’ insurance covers tenants and their belongings if they cannot return home or their home is damaged while away. In Austin, renters insurance typically covers personal property damage, loss of rent, and pet damage.

While each policy varies, knowing what renters insurance includes can help you stay safe and protected while living in Austin.

What are the types of renters insurance coverage?

When looking for renters insurance in Austin, there are a few things to remember. The main types of coverage are as follows:

- Dwelling liability: This type of coverage protects you from any legal action that may be taken against you or your property because of an accident in the home you’re renting. It can cover damages caused by someone else, such as a guest or pet, and protect you from civil suits.

- Damage to personal property: This type of coverage will reimburse you for losses due to theft, damage by animals, and other types of accidents on your personal belongings inside the rental property.

- Property damage: This covers any loss or damage to the rental property itself, whether caused by weather events like floods or tornadoes, vandalism, or accidents involving other people or their pets.

renters insurance cover

What is covered by renters insurance in Austin?

Renting a property in Austin means you are taking on additional risk. That’s why it’s important to have renters insurance in place.

Renters insurance covers you and your belongings if something happens to the rental property. Some of the things that may be covered by renters insurance in Austin include:

- Property damage

- Loss of belongings

- Theft

- Personal injury

There are a few things to remember when purchasing renters insurance in Austin.

- First, ensure you understand what your policy doesn’t cover.

- Second, make sure you have enough coverage to cover your needs.

- Finally, review your policy monthly to ensure no changes or updates need to be made.

Tips for choosing the right renter’s insurance policy in Austin

If you’re considering renting in Austin, it’s essential to know what kind of renters insurance policy will cover your belongings – and what won’t. Here are some tips for choosing the right renter’s insurance policy in Austin:

- Understand your specific needs. What does your rental agreement state? Some policies only cover physical damage, while others include accidental damage, theft, and even loss due to natural disasters like floods or earthquakes.

- Talk to a specialist. A trusted insurance advisor can help you understand your specific risks and recommend the best policy for you. They can also offer advice on protecting yourself from potential dangers, such as breaking safety laws or making unauthorized modifications to your rental property.

- Compare rates and coverage options online. Several online insurers offer detailed rate comparisons that include coverage details for various situations (including renter’s insurance).

- Review ratings and reviews. Beyond just looking at the price, read customer reviews to get an idea of how well the insurer handles claims and responds to questions after an incident.

- Request quotes from several providers before settling on a policy. Don’t be swayed by one low quote – compare rates across different companies to find one that offers the best value for your needs in Austin!

What are the benefits of renters insurance?

Renting can be a great way to test out a new city or neighborhood, but it can also be an expensive proposition. That’s why it’s important to have renters insurance in case of something unexpected.

Here are some of the benefits of renters insurance:

- Coverage for theft and damage from unauthorized entry or burglary

- Protection against fire, smoke, water, and windstorm damage

- Medical coverage for you and your guests in the event of an accident

- Extended protection for you and your belongings if you have to move out quickly due to a natural disaster

renters insurance cover

Tips to save money on renters insurance

If you’re unsure if renters insurance is right for you, here are a few tips to help you get the coverage you need and save money.

- Compare rates from different providers to find the best deal. There are several online tools and calculators available that can help you do this.

- Beware of hidden fees: Some providers may charge extra for extended coverage or frequency of claims payments. Be sure to read the fine print before signing up.

- Consider bundling your insurance: Many providers offer bundling options, which means that you can combine your home and renters insurance policies into one package deal. This can save you money on both policies.

- Plan ahead: Renters’ insurance typically doesn’t cover personal belongings like furniture or appliances, so consider these items when budgeting for coverage.

- Shop around: Don’t be afraid to ask your insurance provider for a free quote and compare different options. You may be surprised at how much you can save by choosing the right policy.

How much does renters insurance cost in Austin?

The cost of renters insurance in Austin ranges from around $30 to $75 per month.

Who is eligible for renters insurance in Austin?

There are a few things renters insurance in Austin covers that homeowners insurance may not.

Coverage typically includes damage to property and possessions, loss of rent, and theft.

In addition, some policies may also cover you if you have to evacuate due to a natural disaster like a hurricane or wildfire.

What should I do if my belongings are stolen while I’m out of town on vacation?

If your belongings are stolen while you’re out of town on vacation, you should contact the hotel or hotel chain where you were staying to file a theft report.

You may also consider contacting a local police station to report the theft.

renters insurance cover

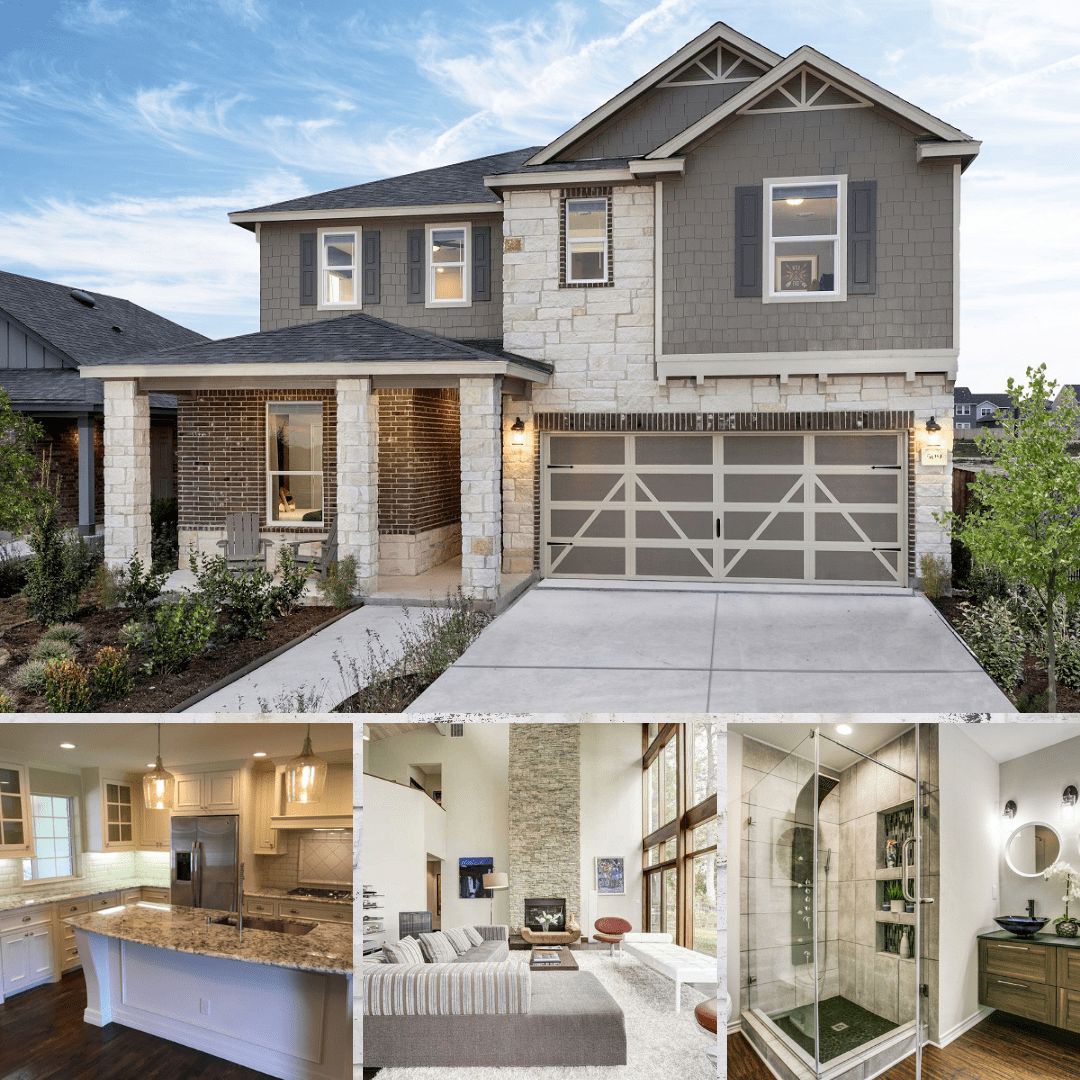

I am a homeowner in Austin. Can I get renters insurance?

If you’re a homeowner in Austin, renters insurance might be something you want to consider. The policy typically covers things like property damage and theft, and personal injuries that occur during your tenant’s stay. Your landlord or management company might also be covered under the policy.

Some important things to keep in mind when buying renters insurance in Austin:

- Make sure the policy covers all your properties, not just the one where you live.

- If you have multiple rental properties, ensure each is covered separately.

- Always check coverage rates and limits before purchasing a policy. You might find that a higher deductible or limit offers better value.

What are the minimum coverages for renters insurance in Austin?

The Austin renters insurance policy must include minimum coverages: property damage, personal injury, and theft.

Conclusion

In Austin, renters insurance typically covers personal property damage, loss of rent, and pet damage. While each policy varies, knowing what renters insurance includes can help you stay safe and protected while living in Austin.

0 Comments