Looking for personalized car insurance advice? Contact us today for tailored solutions.

10 Critical Questions to Ask Before Purchasing Car Insurance

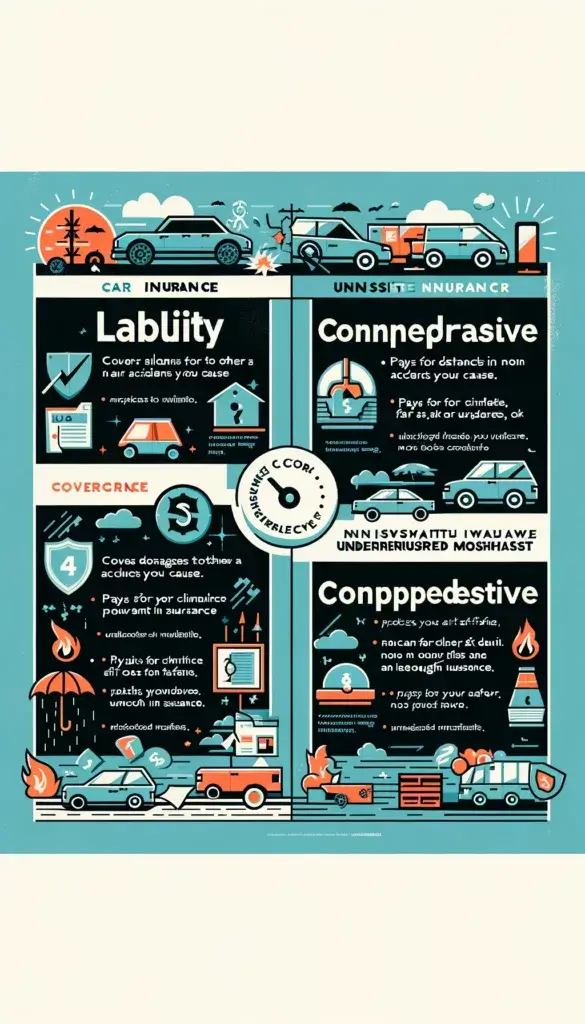

1. What Types of Coverage Do I Need?

Understanding the different types of coverage is crucial. Liability insurance is mandatory in most states, including Texas, covering damages you cause to others. Collision and comprehensive coverages protect your vehicle against accidents and other damages like theft or natural disasters. Don’t forget about uninsured/underinsured motorist coverage, essential for protection against drivers with insufficient insurance.

2. How Much Coverage Do I Need?

The amount of coverage depends on your specific needs, including the value of your assets and vehicle. Opting for higher liability limits can safeguard you against financial ruin in case of serious accidents.

3. How Can I Get the Best Rates?

Shopping around is key. Compare quotes from multiple insurers to find the best rates. Remember, the cheapest option isn’t always the best. Look for a balance between cost and coverage.

4. What Deductibles Should I Choose?

Your deductible amount can significantly affect your premium. Higher deductibles lower your premium but increase your out-of-pocket expenses in an accident. Choose a deductible that you’re financially comfortable with.

5. Is the Insurance Company Reputable?

Ensure the company is licensed in Texas and has a strong financial standing. Customer service and the ease of filing a claim are also critical factors to consider.

6. What Discounts Are Available?

Many companies offer discounts for good drivers, multiple policies, safety features on your vehicle, and more. Always ask about potential savings.

7. How Often Should I Review My Policy?

Your insurance needs can change. Regularly reviewing your policy ensures it still meets your needs, especially after major life events like buying a new car or moving.

8. How Is the Company’s Customer Service?

Good customer service can make a big difference, especially when filing a claim. Research reviews and ratings to gauge customer satisfaction.

9. What Is the Claims Process Like?

Understanding the claims process and typical settlement times can help set your expectations in case of an accident.

10. What Factors Affect My Car Insurance Rates?

Factors include your driving record, the type of vehicle you drive, your age, and your location. Even your credit score can impact your rates in some states.

Essential Car Insurance Coverages in Austin

Liability Insurance:

Often considered the foundation of auto insurance policies, liability insurance is a legal requirement in most states. It’s designed to cover the costs associated with bodily injuries and property damage you are responsible for if you’re at fault in an accident. However, it’s crucial to note that liability insurance does not offer coverage for your own injuries or damages to your vehicle. Experts recommend considering higher liability limits than the state minimum to protect your financial well-being in case of a serious accident.

Collision Insurance:

This coverage is essential for paying for repairs to your vehicle following an accident, regardless of who was at fault. Whether you collide with another vehicle or hit a stationary object like a tree, collision insurance steps in to cover the repair costs. Opting for collision insurance is particularly advisable if you own a newer or higher-value vehicle, as it can significantly mitigate financial losses after an accident.

Comprehensive Insurance:

Unlike collision insurance, comprehensive coverage addresses non-collision-related damages to your vehicle. This includes a wide range of incidents such as theft, vandalism, fire, hail, and other forms of natural disasters. Comprehensive insurance is invaluable for protection against unpredictable events that can cause substantial damage to your vehicle, ensuring you’re covered beyond just road accidents.

Uninsured/Underinsured Motorist Insurance:

Despite laws requiring drivers to have insurance, not everyone follows these regulations. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks adequate insurance. This coverage can help cover medical expenses and, in some policies, vehicle damages, providing an essential safety net in such scenarios.

How to Secure the Best Car Insurance Rates in Austin

Driving Record:

Insurers heavily weigh your driving history when determining your premiums. A clean driving record without accidents, traffic violations, or DUIs suggests you’re a lower risk, potentially lowering your insurance rates. Conversely, a history of driving infractions can lead to higher premiums.

Type of Vehicle:

The make, model, and age of your vehicle play a significant role in your insurance costs. High-performance or luxury vehicles typically cost more to insure due to higher repair costs. Similarly, cars with good safety ratings or theft-deterrent systems may be eligible for lower rates.

Location:

Where you live affects your insurance rates due to factors like traffic density, road conditions, and the likelihood of theft or vandalism. Urban areas with higher crime rates or traffic congestion often see higher insurance premiums compared to rural areas.

Age:

Younger drivers, especially teenagers, usually face higher insurance rates because of their perceived inexperience and higher risk of accidents. Rates tend to decrease as drivers gain more experience and have a clean driving record over time.

Gender:

Statistically, certain age groups may see differences in rates between genders due to the different risk profiles. However, this factor is becoming less significant in some states that have made it illegal to consider gender when calculating car insurance premiums.

Marital Status:

Married drivers often receive lower car insurance rates than single drivers, as insurers view marriage as a factor associated with lower risk and more stability.

Understanding these details about car insurance types and the factors influencing rates can help consumers make more informed decisions when purchasing their policies, ensuring they choose the right coverage for their needs and budget.

The Necessity of Car Insurance in Austin, Texas Before Buying a Car

Understanding Your Car Insurance Needs in Austin

Before you make a car purchase in Austin, Texas, it’s crucial to have car insurance lined up. This isn’t just a wise precaution—it’s a requirement. In Texas, drivers must carry liability insurance as a minimum. This type of insurance covers damages to other people or property if you’re at fault in an accident. However, it’s prudent to consider additional coverages, such as collision and comprehensive insurance, to protect your investment thoroughly.

For more information on Texas’s car insurance requirements, visit the Texas Department of Insurance website. Check your vehicle’s safety rating on the NHTSA or IIHS website to understand how it might impact your insurance costs.

Securing the Best Car Insurance Rates

Securing a favorable insurance rate requires research and strategy. Start by shopping around and comparing quotes from multiple insurance companies. Don’t hesitate to inquire about potential discounts for which you may be eligible, such as those for safe drivers or multiple policies. Opting for a higher deductible can lower your premium, but ensure it’s an amount you’re comfortable with in case of a claim.

Smart Strategies for Lower Insurance Costs

Shop Around: Always compare rates from different insurers to find the best deal.

Inquire About Discounts: Many insurers offer discounts for various reasons, including having multiple policies with them or a record of safe driving.

Adjust Your Deductible: A higher deductible could significantly reduce your premium, but make sure it’s an amount you can afford.

Minimum Coverage: Consider whether you need more than the state-required minimum coverage, especially if your vehicle is older.

Driving Record: Maintain a clean driving record for lower rates.

Vehicle Ownership: If you own your car outright, comprehensive and collision coverage might be optional based on the car’s value.

Credit Score: Improving your credit score can also lead to better insurance rates.

Annual Comparisons: Rates can change, so compare insurance rates annually to ensure you’re still getting the best deal.

*Learn how your credit score could affect your car insurance rates at NerdWallet.

*For tips on how to become a safer driver and possibly lower your insurance rates, visit SafeCar.gov

Conclusion Know Before Buying Car Insurance

Ready to find the perfect car insurance plan? Get your free quote now and drive with confidence in Austin.

0 Comments