Personal Property Replacement Cost Coverage for Homeowners?

Get Payed the Replacement Cost for Items at the Time of Loss

// AUSTIN home PROTECTION

Personal Property Replacement Cost

This optional coverage can be applied to your homeowner’s insurance policy and covers the total cost to repair — or replace — most damaged items with their brand-new value in the event of a covered loss.

- This coverage distinguishes how you would like your items valued if damaged.

- Your deductible for this coverage is your Personal Property deductible.

Ready for a quote?

What’s the difference between replacement cost and actual cash value?

Replacement cost and actual cash value are just different ways of calculating how much you’ll be paid if your property is damaged or needs to be replaced as a result of a covered loss.

In general, replacement cost coverage pays to replace your belongings with new ones or ones of similar value if they are new. On the other hand, actual cash pays the value of what your belongings are worth today, considering things like age and wear and tear.

Example

Let’s say your dining room table was damaged in a covered loss. When you bought it a few years ago, it cost $2,000. Today, due to normal wear and tear, it’s worth $1,000. Now, let’s look at how each of you would pay for your damages.

- Replacement Cost Coverage would pay to replace your table with a brand new one. The exact table is no longer made but is of similar quality and now costs $3,000. You’d be paid $3,000.

- Actual cash value would pay you what it’s worth today, which is $1,000.

Your homeowner’s insurance policy usually includes the actual cash value, whereas Replacement Cost Coverage is typically optional.

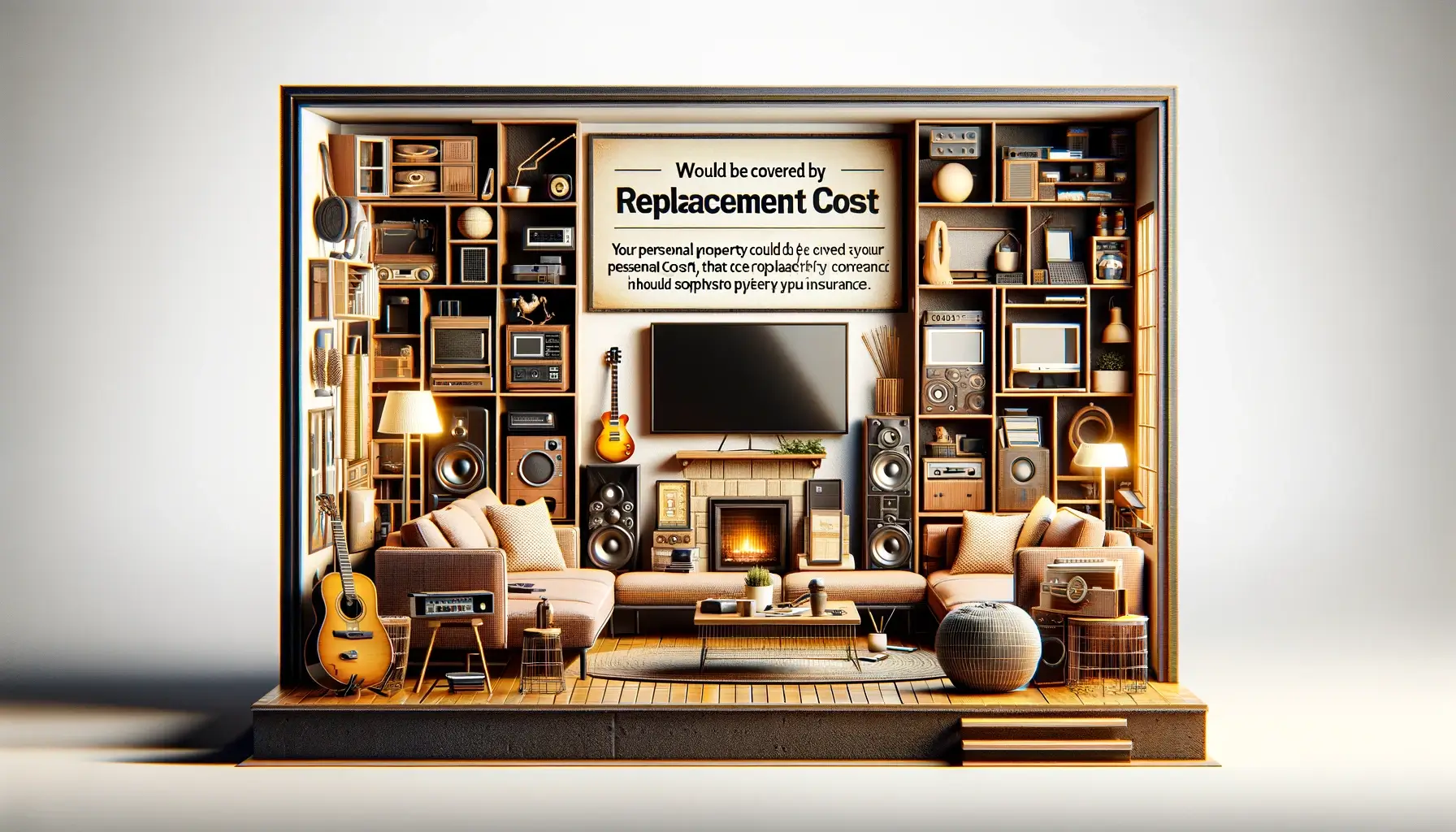

What is covered by Personal Property Replacement Cost Coverage?

In general, Personal Property Replacement Cost Coverage pays for damage to your belongings inside your home if the damage is caused by a covered loss.

Examples of personal property that can be covered

- Electronics (ex., TVs, computers, tablets, phones)

- Clothes

- Furniture (ex., couch, chair, bed)

- Tools

- Musical instruments

- Jewelry (in some cases)

- Artwork

- Appliances (ex., refrigerator, stove, microwave)

Note that if you own valuable items that are worth over a specific amount (set by your insurance company), you may need to buy additional coverage to ensure they are covered.

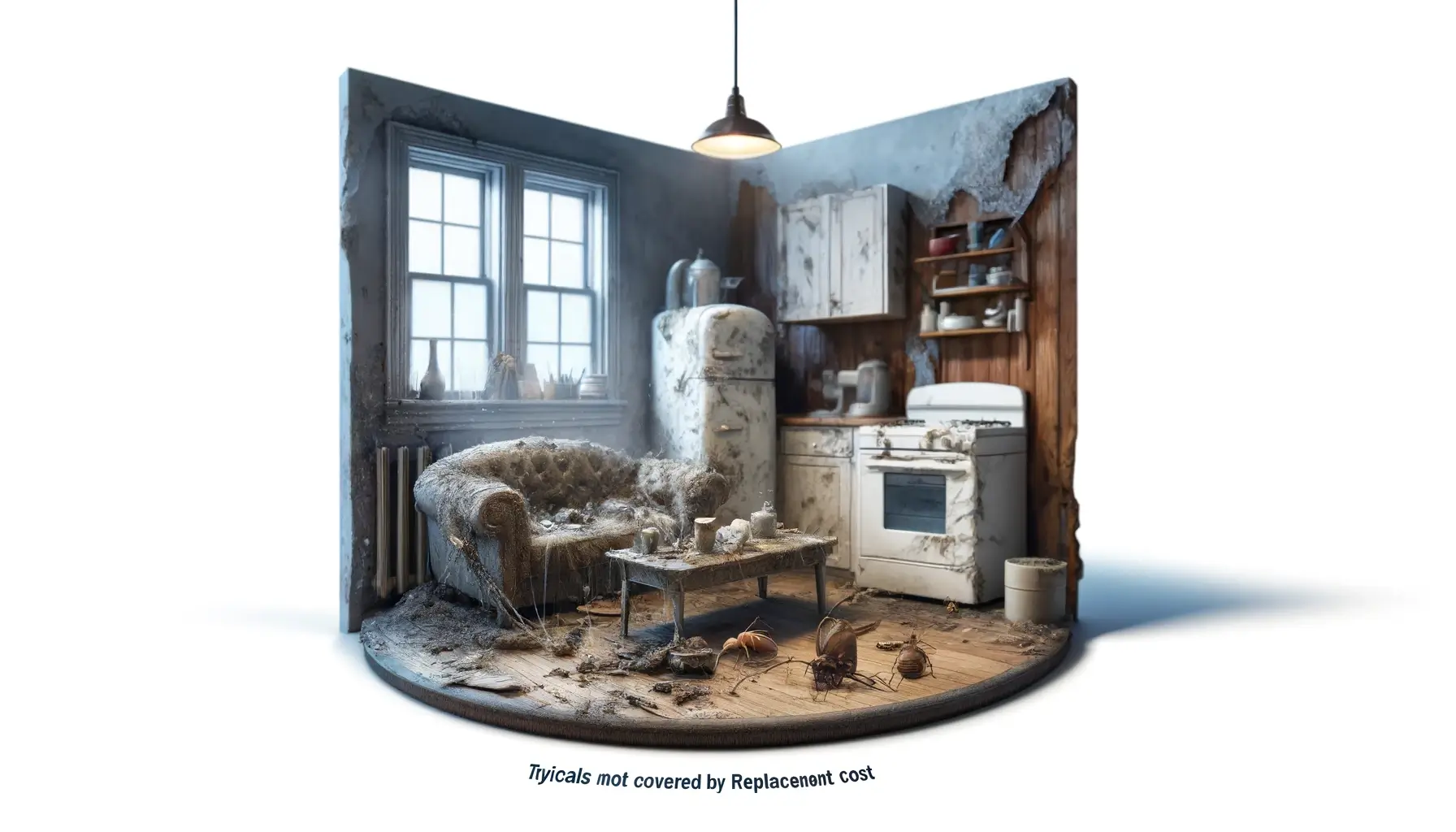

What is not covered by Personal Property Replacement Cost Coverage?

In general, Personal Property Replacement Cost Coverage will not pay for damages caused by

- Floods

- Termites and/or insects

- Pest (animal) infestation

- Mold or mildew

- Normal wear and tear

Personal Property Replacement Cost Coverage typically has limits for expensive items. For example, a policy may only cover up to $1,000 per piece of jewelry or up to $2,500 total for jewelry in a covered loss. Therefore, it is essential to understand the value of your belongings and your specific policy limits and deductibles to make sure your items are covered.

// faq

qustions about insurance policy

Are there ways I can help protect my home?

Homeownership is a big responsibility, but it can be even more rewarding. You’re ahead of the game with preventive maintenance and know your home will last for years with proper care!

How many homeowners' insurance coverage do I need?

Homeowners’ insurance coverage is an essential topic for many homeowners, but it can be challenging to understand what exactly you need.

You might think that the amount of money spent on your house each year should cover anything from a broken pipe in one bathroom to replacing everything inside if there were flash floods or fire damage!

Having an agent who knows their field of research helps analyze and research policies will ensure that they get just enough protection at the best possible price and make sure no other gaps exist where something slash happens without planning.

How can I prevent claims at my home?

The best way to prevent claims at your home is by being a vigilant and careful consumer. It would help if you recognized potential hazards before they happen.

Don’t let things get cluttered or damaged, so you don’t have an accident that leads liability insurers into paying out money on behalf of their clients (you).

Should I get an umbrella policy too?

If you’re involved in an auto collision, and the other person’s fault is unclear, it may be time to consider getting extra protection.

Umbrella policies offer increased financial compensation for injuries, damage done on behalf of a covered individual that results from accidents occurring outside their control (such as driving into traffic), plus legal fees that will arise.

Do I need flood insurance too?

Floods aren’t just a coastal problem. They can happen anywhere, especially in High-Risk Flood Zones, and many homeowners don’t realize their policy doesn’t cover flood damage either!

If you live near the coast, near a River, or Lake, it may be worth looking into purchasing coverage for your home. Even though these types of storms rarely make headlines, they still cause tons of dollars worth of losses every year.

Allow us to be in your corner when making decisions regarding insurance policies that will keep covered, whether it’s windstorms, fires, hail, or rain.